Content Hub

Content

Exclusive intelligence – Risk Live 2020

Risk Live is developed by the editors of Risk.net. The agenda is curated to cover critical market issues and trends, as influenced by Risk.net subscribers. Why wait until the event to explore these themes? You can sign up for a trial here.

Four key questions financial institutions should be asking their technology partners

Resilience is a critical characteristic of financial systems. There will always be difficulties, just like there will always be another crisis. There are four questions that financial institutions should be asking of their technology partners to ensure their systems are resilient: is your solution integrated, future-proof, focused and transparent?

RISK LIVE VIRTUAL WEEK

Watch a series of live and exclusive digital presentations, panels and interviews covering the most pressing issues facing risk managers today that took place during our virtual week at the beginning of July.

All session are free to watch and are available on demand.

Related articles for Risk Live Virtual Week

Libor death notice could be served this year – FCA

Announcement may come soon after Isda’s fallback protocol takes effect in November.

Lagging futures market holding back swaptions RFR transition

“Elephant in the room” is hindering non-linear growth and swap market liquidity, say rates traders.

Sonia term rate nears ‘beta’ release, while SOFR struggles

ARRC chair says current liquidity in SOFR derivatives is insufficient to create a term rate

Shifting Libor fallback window jolts basis market

Fallback spreads widened more than 20% after UK regulator says Libor’s end could be announced this year

Risk Live virtual week playback: BlackRock’s Fishwick on buy-side risk

In this presentation, Edward Fishwick, global co-head of risk and quantitative analysis at BlackRock, discusses the evolution of buy-side risk management over the past decade.

Risk Live 2019

Last year, Risk Live 2019 gave attendees cutting edge insights to help their businesses stay ahead. From AI, to risktech, DLT, quantum computing, Libor and beyond. Here’s a snap-shot of the content we produced from the discussions at Risk Live 2019:

UBS exec: first trades via USC could take place this year

Banks and prop shops expect more trading tie-ups

JP Morgan warming to derivatives-based term RFR rates

Dealers issue rallying cry for cross-currency benchmark reform

JP Morgan’s Hudson: innovation stuck in trading web

Not a subscriber? Take a trial here to read the articles.

Risk.net’s review of 2019: Shaken, not stirred

Look back with us on last year’s biggest stories – and those with greatest potential to shape the coming 12 months.

Review of 2019: shaken, not stirred

BoE probes banks on machine learning use

Goldman and SG on alternative data: do believe the hype

Isda backs regulatory push on derivatives data project

Model risk managers: banking’s future VIPs

BoE drops Libor for hedging UK forex reserves

Not a subscriber? Take a trial here to read the articles:

Webinars

Risk.net webinars are built around expert journalism and provide news, opinion and insight on the latest industry developments.

Hear how leading financial firms are transitioning from a Libor dependant landscape

Leveraging big data to enhance factor investing in private markets

Bloomberg article | 2022: a market risk odyssey

A great way to stake a claim on the future is to lead with a date: think 1984 or 2001: A Space Odyssey. The January 2019 edition of the Basel Committee on Banking Supervision’s (BCBS) Document 457, Minimum Capital Requirements for Market Risk, leads with a date in the very first sentence...

Equality = innovation: Accenture gender equality research report

Innovation equals survival. It’s well documented that in this age of widespread disruption, companies must innovate continuously, creating new markets, experiences, products, services, content or processes. So how can leaders encourage innovation? It’s more than recruiting the brightest minds. While having the best talent is clearly an asset, people need the right culture to flourish.

https://www.accenture.com/gb-en/about/inclusion-diversity/gender-equality-innovation-research

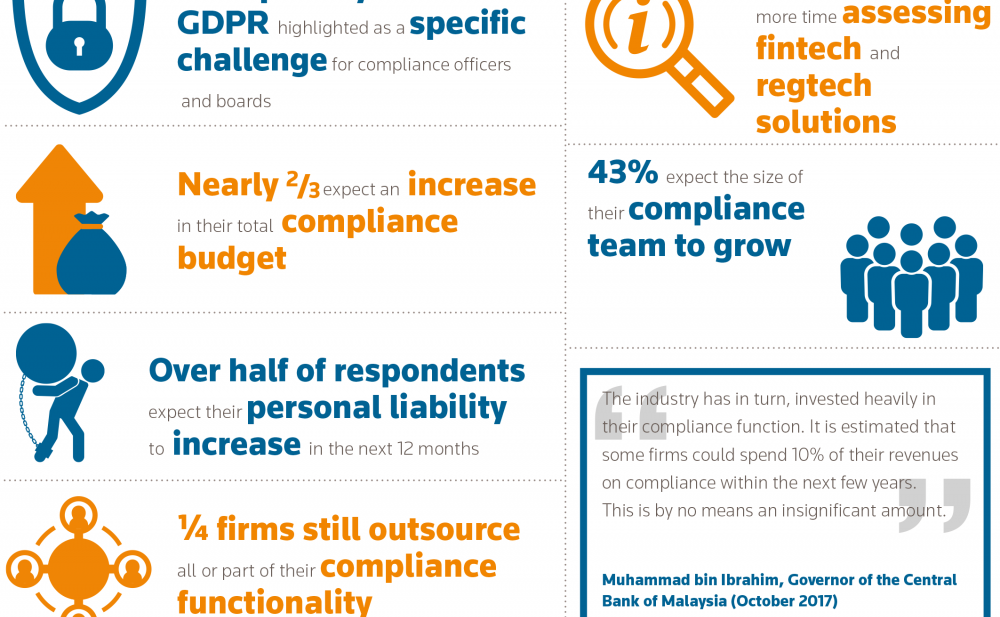

Cost of Compliance Report 2019

Thomson Reuters is excited to join Risk Live as a key partner. Visit our exhibition stand where we will be launching our 10th Annual Regulatory Intelligence Cost of Compliance Report. Learn about the key highlights from our industry renowned report directly from the experts during two live speaking sessions.

The report gives an unparalleled insight into the challenges facing risk and compliance officers in financial services firms around the world. Register your details and be the first to receive the report straight to your inbox on 27th June.

LIBOR Update: the current state of the alternative reference rates

Demystifying artificial intelligence in risk and compliance

Many in the financial services industry don't yet have a straightforward guide to AI techniques and making them work.

A recent report by Chartis provides just this, and we are pleased to offer you free access to the report here.

Regulatory compliance & reporting

Counting and cutting the cost of compliance is a never-ending mission, and financial institutions continue to strive to adjust the organisational levers of compliance cost.

Download your complimentary copy of Chartis' report here to ensure that your organisation is up to date with latest best practice.

A layer above: gauging cloud's latest promise for financial services applications

Cloud technology’s presence is booming, yet its adoption has mainly been incremental. Based on research conducted by IBM in association with Risk.net, this whitepaper explores firms’ general progress towards cloud transformation and what factors are likely to accelerate cloud adoption.

Numerix Oneview for Margin

The evolution of GRC – New tools for the first line of defence

This white paper explores how, in the rapidly changing global financial markets, next-generation governance, risk and compliance solutions are empowering growing numbers of organisations and business users to make risk-aware decisions and increase process efficiency and effectiveness.

AI in RegTech: a quiet upheaval

In certain disciplines, AI could have a transformative impact, but only if users properly familiarise themselves with how it work.

This complimentary report from Chartis helps risk professionals across RegTech assess the value of AI.

Chartis Big Bets 2019

Information is power, and many FS professionals struggle to predict what the "next big thing" will be. Make sure you keep pace with tech developments in the industry, download Chartis’ annual prediction of the top trends shaping risktech markets.