Sponsorship opportunities

Sponsorship opportunities

About Cyber Risk Summit

The OpRisk Global Series attracts more than 650 senior decision-makers across operational, cyber, third-party, digital, technology and emerging risks, along with governance, financial crime and compliance.

This senior audience is seeking innovative insights and practical solutions to the industry’s most pressing challenges.

Audience breakdown

Operational Risk global reach

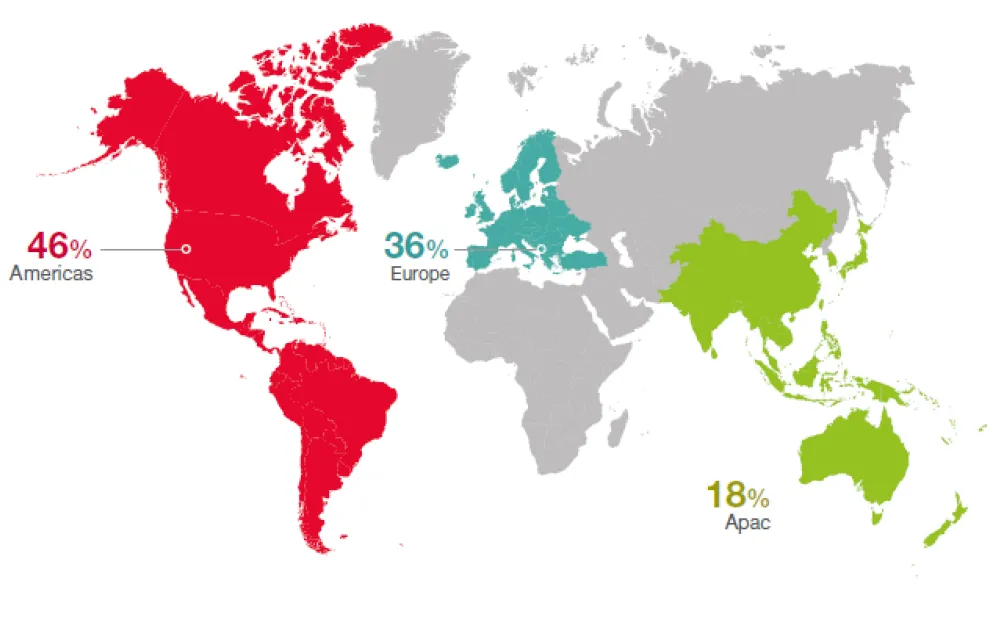

The vast Operational Risk database spreads across the Americas, Europe and APAC.

Americas - 46%

Europe - 36%

APAC - 18%

480000

contacts across the Risk.net database

14000

delegates attended a Risk.net event over the past year

28000

professionals subscribe to Risk.net newsletters

Key topics

Regulatory expectations

Cyber resilience

Cyber risk quantification

Risk appetite, tolerances and decision making

Third parties and supply chain attacks

Distributed Denial-of-Service (DDoS) attacks

Digital transformation and the cloud

Ransomware, key attack vectors and banks drops

The event brings a collective view on how we can better manage operational risk, not just for the firm but for the financial industry as a whole.

Morgan Stanley

Extremely knowledgeable speakers, engaging and fielded any questions.

State Farm

A well-organized event with good networking opportunities.

SmartStream

Previous attendees and sponsors

HSBC is a financial services organisation that serves more than 40 million customers, ranging from individual savers and investors to some of the world’s biggest companies and governments. Its network covers 64 countries and territories, and its expertise, capabilities, breadth and perspectives open up a world of opportunity for its customers. HSBC is listed on the London, Hong Kong, New York, Paris and Bermuda stock exchanges.

MetricStream is a global software-as-a-service leader of integrated risk management and governance, risk and compliance (GRC) solutions that empower organisations to thrive on risk by accelerating growth via risk-aware decisions. It connects governance, risk management and compliance across the extended enterprise. MetricStream's ConnectedGRC and three product lines – BusinessGRC, CyberGRC and ESGRC – are based on a single, scalable platform that supports clients on their GRC journeys. For more information please click this link www.metricstream.com

At EY, we share a single focus — to build a better financial services industry, one that is stronger, fairer and more sustainable.

Our strength lies in the proven power of our people and technology, and the possibilities that arise when they converge to reframe the future.

Our professionals are dedicated to the industry, and live and breathe financial services. This deep sector knowledge combined with a holistic point of view, delivers true value from strategy through to implementation. Whether your business challenge is specific, complex, small or large, we can be trusted to deliver solutions that work for today and tomorrow.

By using technology as a tool, to transform what a business can be, and people can do, we are building long-term value for our financial services clients. It is how we play our part in building a better working world.

Linklaters is a leading global law firm, supporting and investing in the future of our clients wherever they do business. We combine legal expertise with a collaborative and innovative approach to help clients navigate constantly evolving markets and regulatory environments, pursuing opportunities and managing risk worldwide.

Our 5,200 people, of which almost half are lawyers, are located across 30 offices in 20 countries. In order to offer our clients the highest quality advice, our lawyers across three divisions; Corporate, Dispute Resolution and Finance, specialise in industry sectors as well as practice areas.

The usage and Risks from Spreadsheets and other End User Computing (EUC) tools such as Python/R/SQL/SAS/RPT files and Access databases continues to increase, in response to fast changing market conditions, economic uncertainty and regulatory mandates.

CIMCON’s EUC Insight is an intelligent, automated and unique software platform that reduces these risks across the entire EUC Life Cycle. Its Discovery, Inventory, Monitoring and Disposition modules identify new EUCs and assess risk, inventory them, monitor for high risk changes and dispose as needed. A single user interface integrates all modules and file types. XLAudit is a visual, easy to use Excel plugin that performs quick validation, logic and error checks on spreadsheets and documents the results.

Whether your EUCs are already on the Cloud or will be, CIMCON tools and services can help. We support all major Cloud repositories and can help fix links that break when moving to Cloud.

We can also migrate your legacy Access databases to a web application on cloud. CIMCON has a wide range of consulting, technology and reseller partners around the globe. With 25 years of experience, 500 customers in 30 countries, and a #1 ranking by Gartner, CIMCON is the only company you will ever need to manage all of your EUC needs.

Milliman is among the world’s largest providers of actuarial, risk management, and related technology and data solutions. With over 60 offices around the globe, our consulting and advanced analytics capabilities encompass the fields of healthcare, property and casualty insurance, life insurance, financial services, and employee benefits. Our breadth of expertise and data solutions provide insight into the interplay between physical, health, and economic risks, as well as the ability to communicate those risks and inform key decisions for governments, communities, and businesses around the world.

BNY Mellon is a global investments company dedicated to helping its clients manage and service their financial assets throughout the investment lifecycle. Providing financial services for institutions, corporations or individual investors, BNY Mellon delivers informed investment and wealth management and investment services in 35 countries.

Interos protects customers’ brand and operations from risk in their extended supply chains and business relationships. The first AI-powered platform for eliminating multi-party, multi-factor risk from 3rd, 4th to nth tier parties, Interos automates discovery, detection, and response to financial, operations, governance, geographic, and cyber risk. Designed by experts and leveraging the company’s 15 years of experience in managing the world’s most complicated supply chains, Interos provides real-time risk management for the largest commercial brands in manufacturing, financial services, and aerospace and defense.

Stand 121

Products and Services: Premium Finance

With over 20 years' experience in the industry, we're a leading provider of insurance premium finance.

Why choose BNP Paribas Personal Finance for Insurance Premium Finance?

We will help you to grow your business by:

- Attracting new customers

Our transparent Premium Finance Solutions help you to attract more business

- Retain valued customers

Best in class customer service creating customer loyalty and trust

- Increase your sales

Increasing policy sales with advanced data insight and analytics

Get in touch to find out how our Premium Finance team can help you today.

Contact name: Angie Burgess

Contact tel: 07771 840201

Address: Chadwick House, Blenheim Court, SOLIHULL, West Midlands, B91 2AA

OneTrust Vendorpedia™ is the largest and most widely-used technology platform to operationalize third-party risk. The offering enables both enterprises and their vendors with technology solutions that include: the Third-Party Risk Exchange, a community of shared (and pre-completed) vendor risk assessments with 70,000+ participating vendors; Questionnaire Response Automation, a tool that helps organizations answer incoming security questionnaires; and Third-Party Risk Management software, a platform to streamline the entire vendor lifecycle, from onboarding to offboarding. More than 7,500 customers of all sizes use OneTrust, which is powered by 75 awarded patents, to offer the most depth and breadth of any third-party risk, security, and privacy solution in the market. OneTrust Vendorpedia offers purpose-built software designed to help organizations manage vendor relationships with confidence, including and integrates seamlessly with the entire OneTrust platform, including – OneTrust Privacy, OneTrust GRC, OneTrust DataGuidance™, and OneTrust PreferenceChoice™.

Fusion Risk Management is a leading industry provider of cloud-based software solutions for operational resilience, encompassing risk management, third-party risk management, IT and security risk, business continuity and disaster recovery, and crisis and incident management. Its products and services take organisations beyond legacy solutions and empower them to make data-driven decisions with a comprehensive and flexible approach through one system. Fusion and its team of experts are dedicated to helping companies achieve greater operational resilience and mitigate risks within their businesses.

Phyton Consulting focuses on the most complex initiatives facing our clients and strives to be the best subject matter-led, execution-focused group on the street. Our services are conceived to address your industry-specific business and data challenges with the right blend of tactical and strategic execution.

Bottomline (NASDAQ: EPAY) helps make complex business payments simple, smart, and secure. Banks rely on Bottomline for domestic and international payments, state of the art fraud detection, insider fraud protection, behavioral analytics, consolidated case management and regulatory compliance solutions. Banks around the world benefit from Bottomline cyber fraud and risk solutions. Headquartered in Portsmouth, NH, Bottomline delights customers through offices across the U.S., Europe, and Asia-Pacific. For more information visit www.bottomline.com.

Archer is a leading provider of integrated risk management solutions that enable customers to improve strategic decision-making and operational resilience with a modern technology platform that supports qualitative and quantitative analysis driven by business and IT impacts.

As pioneers in governance, risk and compliance software, Archer remains solely dedicated to helping customers manage risk and compliance domains, from traditional operational risk to emerging issues such as environmental, social and governance. With more than 20 years in the risk management industry, Archer's customer base represents one of the largest pure risk management communities globally, with over 1,600 deployments, including more than 90 of the Fortune 100.

Want to know more?

Speaker enquiries

Andrew Brennan

Senior conference producer

TEL: +44 207 3169386

EMAIL: andrew.brennan@risk.net